Table of Contents

- Executive Summary

- The Compliance Crisis in Regulated eCommerce

- Understanding Modern SOP Compliance Requirements

- The Digital Adoption Platform Solution

- Implementation Framework for Regulated Industries

- The Apty Advantage in Regulated Environments

- Measuring Compliance Success and ROI

- Future-Proofing Your Compliance Strategy

- Take Action: Transform Your Compliance Strategy Today

- FAQs

Executive Summary

The regulatory compliance landscape for e-commerce operations in regulated industries has reached a critical inflection point. With compliance failures costing organizations millions in penalties and operational disruptions, traditional Standard Operating Procedure (SOP) management approaches are proving fundamentally inadequate for modern digital commerce environments.

This comprehensive guide examines the specific challenges facing pharmaceutical, financial services, and other regulated industries in maintaining operational compliance across complex e-commerce systems. We explore how Digital Adoption Platform (DAP) technology, specifically Apty’s business execution-focused approach, provides a transformative solution that delivers measurable compliance outcomes within 14 days of deployment.

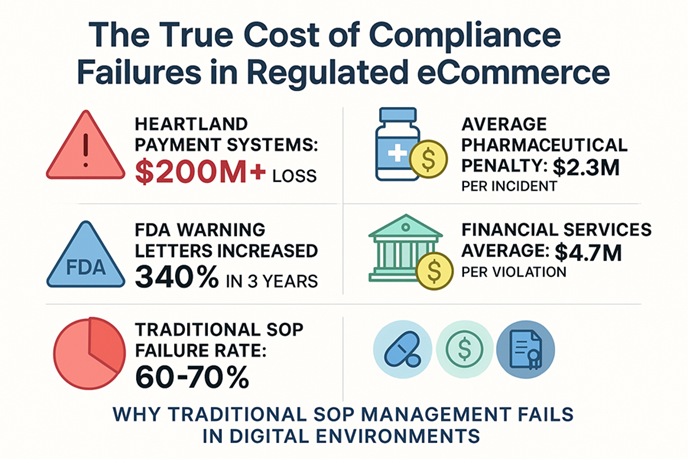

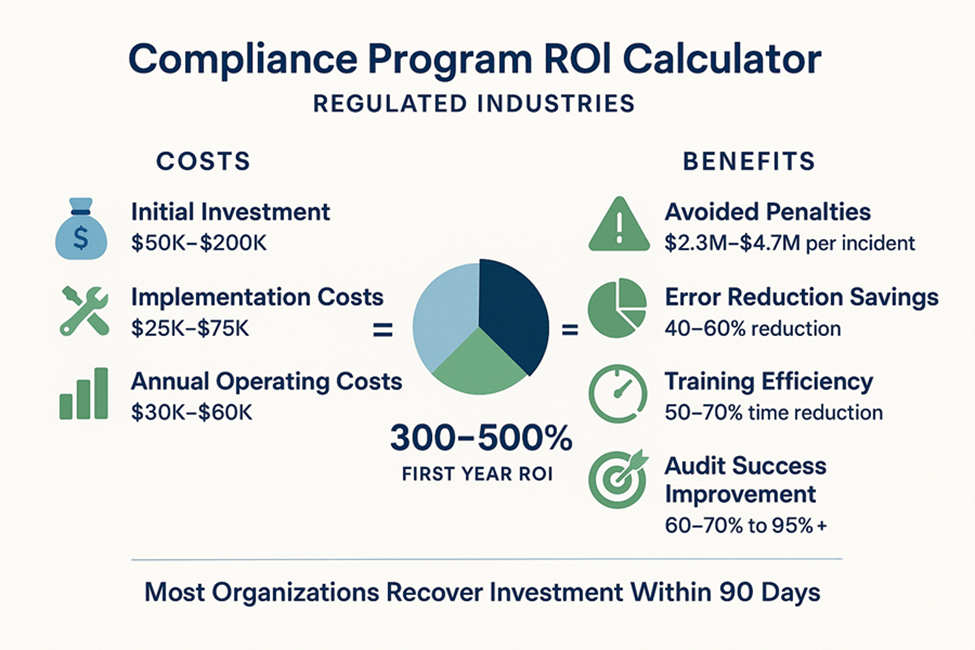

Key findings include the $200+ million cost of major compliance failures, the 340% increase in regulatory enforcement actions, and the 300-500% ROI that organizations achieve through effective DAP implementation. This guide provides regulated industry leaders with the strategic framework and practical insights needed to transform their compliance capabilities and eliminate regulatory risk.

The Compliance Crisis in Regulated eCommerce

The magnitude of compliance failures in regulated e-commerce environments is revealed through a pattern of increasingly severe consequences that extend across industries and geographies.

Consider the pharmaceutical sector, where the FDA’s enforcement actions have intensified dramatically as companies struggle to maintain compliance across digital channels. The agency’s warning letters to online pharmacies have increased by 340% over the past three years, with violations ranging from inadequate identity verification systems to failures in maintaining proper documentation of controlled substance transactions.

Financial services face equally daunting challenges, with payment processing violations alone resulting in over $3.2 billion in penalties during 2024. The complexity multiplies exponentially when organizations operate across multiple jurisdictions, each with distinct regulatory requirements that must be seamlessly integrated into a unified e-commerce platform.

A single transaction may trigger compliance obligations under PCI DSS, GDPR, PSD2, and local banking regulations simultaneously, creating a complex compliance matrix that traditional SOP systems struggle to manage effectively.

The root cause of these failures lies in the fundamental mismatch between static compliance documentation and dynamic operational environments. Traditional SOPs assume a controlled, predictable workflow where procedures can be documented once and followed consistently. eCommerce operations, however, involve complex integrations between multiple systems, real-time decision-making based on dynamic data, and user interactions that vary significantly based on context, geography, and regulatory jurisdiction.

Understanding Modern SOP Compliance Requirements

The regulatory landscape governing eCommerce operations in regulated industries has evolved into a complex ecosystem of interconnected requirements that demand a sophisticated understanding and precise implementation. This evolution reflects not merely the addition of new regulations, but a fundamental transformation in how compliance obligations interact with digital business processes.

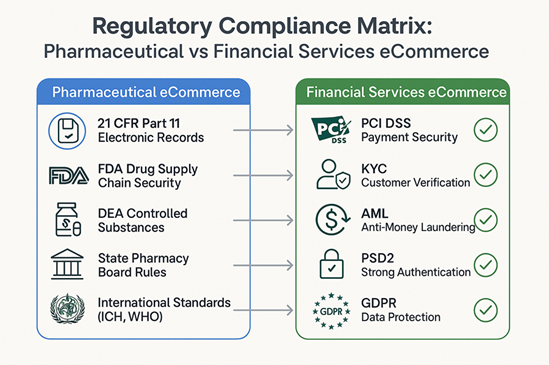

In the pharmaceutical industry, compliance begins with the foundational requirements of 21 CFR Part 11, which governs the use of electronic records and electronic signatures in FDA-regulated activities. These requirements extend far beyond simple documentation to encompass the entire lifecycle of digital interactions, from initial system validation through ongoing monitoring and periodic review.

When pharmaceutical companies engage in eCommerce activities – whether through direct-to-consumer sales, B2B distribution platforms, or integrated supply chain management systems – every digital interaction must comply with these stringent standards. Financial services organizations face an equally complex regulatory matrix, with PCI DSS requirements forming the foundation of compliance for leading payment processors.

The twelve essential requirements of PCI DSS create a comprehensive framework that touches every aspect of eCommerce operations, from network security controls and secure system configurations to vulnerability management programs and access control measures. The complexity multiplies when organizations handle different types of payment data, operate across multiple geographic regions, or integrate with third-party service providers.

The Digital Adoption Platform Solution

Digital Adoption Platforms represent a fundamental paradigm shift in how regulated industries can achieve and maintain SOP compliance in eCommerce environments.

Unlike traditional compliance systems that rely on static documentation and periodic training, DAPs embed compliance guidance directly into operational workflows, providing real-time support that ensures procedures are followed correctly at the moment of execution.

The transformative power of DAP technology lies in its ability to bridge the gap between compliance requirements and operational reality. Rather than requiring employees to remember complex procedures or navigate separate documentation systems, DAPs provide contextual guidance that appears precisely when and where it’s needed within existing applications.

This approach eliminates the cognitive burden of translating abstract procedures into specific actions while ensuring that compliance requirements are met consistently across all user interactions.

Real-time contextual guidance represents the cornerstone of effective DAP implementation in regulated environments. When a pharmaceutical technician processes a controlled substance order through an e-commerce platform, the DAP system can provide step-by-step guidance that ensures proper identity verification, dosage validation, and documentation requirements are met.

The guidance adapts dynamically based on the specific medication, customer location, and regulatory jurisdiction, ensuring that complex compliance requirements are simplified into clear, actionable steps.

Implementation Framework for Regulated Industries

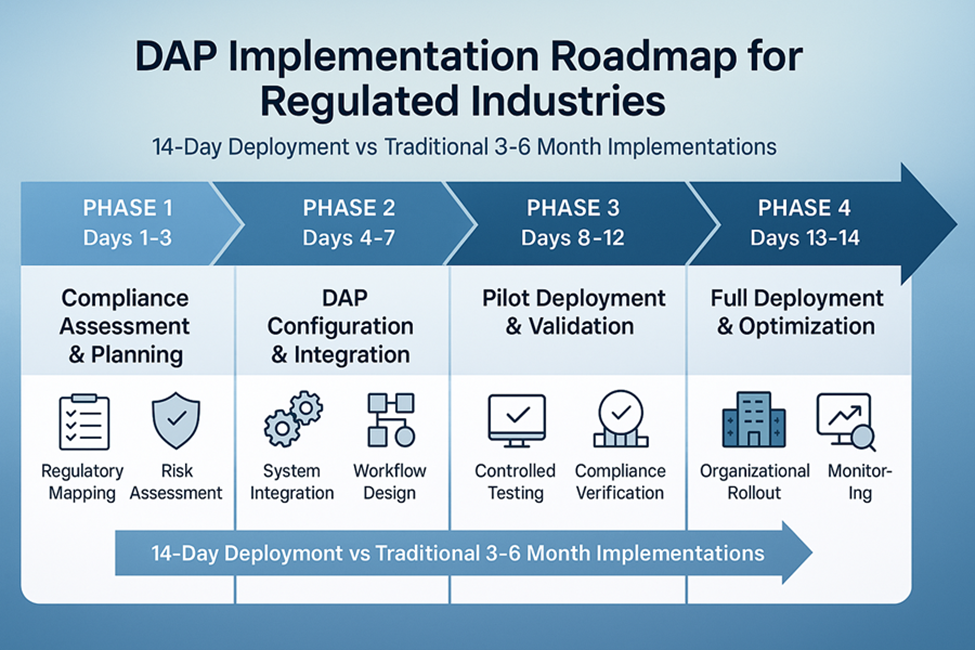

Successful implementation of Digital Adoption Platforms in regulated eCommerce environments requires a systematic approach that addresses the unique challenges and requirements of compliance-driven organizations. The framework must balance the need for rapid deployment with the rigorous validation and documentation requirements that characterize regulated industries.

Phase 1 of implementation focuses on comprehensive compliance assessment and strategic planning. This phase begins with detailed mapping of current regulatory requirements across all relevant frameworks and jurisdictions. For pharmaceutical organizations, this mapping encompasses FDA regulations, DEA requirements, state pharmacy board rules, and international standards for markets where the organization operates. Financial services organizations must map PCI DSS requirements, banking regulations, AML obligations, and jurisdiction-specific payment processing rules.

The current state analysis examines existing SOP systems, compliance procedures, and operational workflows to identify gaps, inefficiencies, and areas of regulatory risk. This analysis extends beyond documentation review to include observation of actual operational practices, interviews with key personnel, and assessment of system capabilities and limitations. The goal is to understand not only what procedures are documented, but also how they are actually followed in practice and where deviations occur.

The Apty Advantage in Regulated Environments

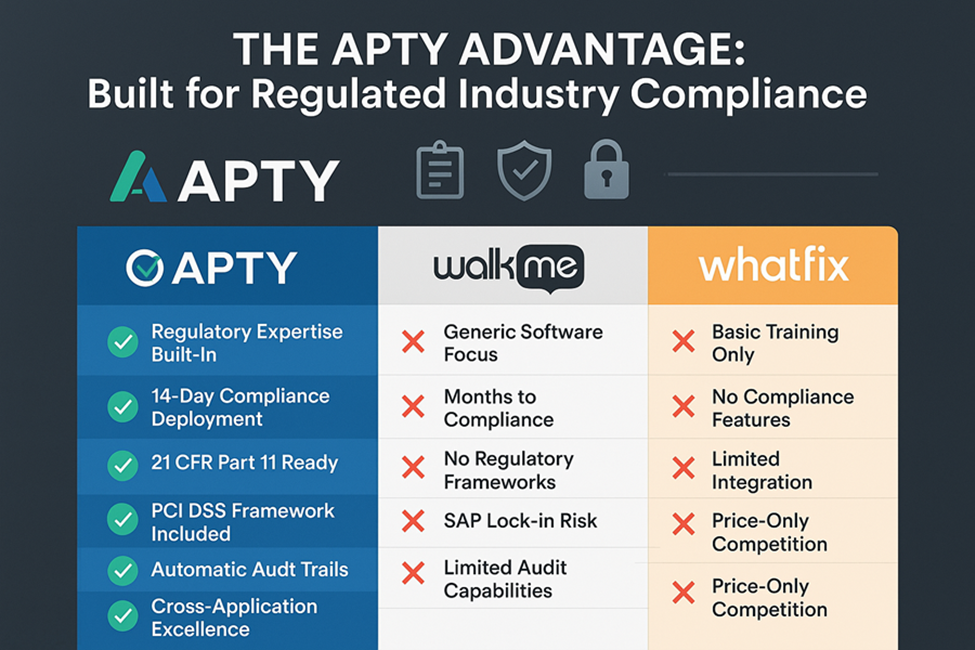

Apty’s approach to Digital Adoption Platform technology represents a fundamental advancement in how regulated industries can achieve and maintain operational compliance in eCommerce environments. While traditional DAP vendors focus primarily on software adoption metrics and user engagement scores, Apty delivers measurable business outcomes that directly address the compliance challenges facing regulated organizations.

The business execution focus that distinguishes Apty from competitors becomes particularly valuable in regulated environments where compliance failures can result in severe financial penalties, operational shutdowns, and reputational damage. Rather than measuring success through feature adoption rates or user engagement metrics, Apty focuses on compliance outcomes, error reduction, and regulatory risk mitigation. This focus ensures that DAP implementation delivers tangible value in terms of regulatory compliance rather than simply improving software utilization statistics.

Rapid implementation capabilities provide regulated organizations with the ability to achieve compliance improvements within 14 days of deployment, a timeline that contrasts sharply with the months-long implementations typically required by traditional compliance systems. This speed advantage stems from Apty’s implementation methodology that prioritizes high-impact compliance processes and leverages pre-built guidance frameworks for common regulatory requirements.

Measuring Compliance Success and ROI

Effective measurement of compliance program success in regulated eCommerce environments requires sophisticated metrics that capture both immediate operational improvements and long-term strategic value. Traditional ROI calculations often fail to account for the unique value proposition that compliance represents in regulated industries, where the cost of failure far exceeds the investment required for success.

Compliance audit success rates provide the most direct measure of program effectiveness, reflecting the organization’s ability to demonstrate regulatory compliance during formal inspections and reviews. Organizations implementing comprehensive DAP solutions typically see audit success rates improve from industry averages of 60-70% to consistently above 95%. This improvement reflects not only better compliance practices but also the comprehensive documentation and audit trail capabilities that DAP platforms provide.

Error reduction percentages demonstrate the platform’s impact on operational quality and regulatory risk. Pharmaceutical organizations implementing DAP solutions for controlled substance dispensing typically see error rates decrease by 40-60% within the first six months of deployment. Financial services organizations report similar improvements in payment processing accuracy and fraud detection effectiveness.

Future-Proofing Your Compliance Strategy

The regulatory landscape governing eCommerce operations in regulated industries continues to evolve at an accelerating pace, driven by technological advancement, changing business models, and increasing regulatory sophistication. Organizations that want to maintain a competitive advantage must develop compliance strategies that can adapt to these changes while maintaining operational effectiveness.

AI-powered compliance monitoring represents the next frontier in regulatory technology, providing capabilities that extend far beyond traditional rule-based systems. Machine learning algorithms can identify patterns in operational data that indicate potential compliance risks before they result in actual violations. Natural language processing can monitor communications and documentation for compliance issues that might escape human review. Predictive analytics can forecast regulatory changes based on industry trends and regulatory agency priorities.

The organizations that thrive in this evolving regulatory environment will be those that embrace technology-enabled compliance strategies while maintaining focus on fundamental compliance principles. Success will require not only sophisticated technology platforms but also organizational cultures that prioritize compliance, leadership that understands regulatory requirements, and operational processes that embed compliance into every aspect of business operations.

Take Action: Transform Your Compliance Strategy Today

The evidence is clear: traditional approaches to SOP compliance in regulated eCommerce environments are failing at an unprecedented rate, creating risks that threaten not only individual organizations but entire industries. The solution lies not in incremental improvements to existing systems but in the fundamental transformation of how compliance is conceived, implemented, and maintained.

The first step in this transformation is an honest assessment of your organization’s current compliance capabilities and vulnerabilities. Where are your greatest regulatory risks? Which processes are most likely to fail during regulatory inspections? How confident are your employees in their ability to follow complex compliance procedures correctly? These questions require candid answers that may be uncomfortable but are essential for effective improvement.

The time for action is now. Every day that passes without effective compliance systems in place is another day of regulatory risk, operational inefficiency, and competitive disadvantage. The organizations that act decisively to transform their compliance capabilities will emerge as leaders in their industries, while those that delay will find themselves increasingly vulnerable to regulatory enforcement and market disruption.

Ready to transform your compliance strategy and eliminate regulatory risk? Book a demo with Apty’s compliance experts to discover how Digital Adoption Platform technology can revolutionize your approach to SOP compliance in regulated eCommerce environments.

FAQs